Have you ever thought about what would happen to your family if you were to die or be incapacitated? That you would need a ‘Fearless Folder’ of important documents organised to protect them in case you died?

I didn’t think about that sort of stuff much either.

I loved the idea of the ‘Fearless Folder’ (as it’s called in the Barefoot Investor for Families) and figured I’d get around to doing it…eventually. I thought uneasily about the fact that I didn’t have a Will or Powers of Attorney, but figured it didn’t matter too much, I was (relatively) young and healthy.

Life has a way of teaching us lessons…

It turned out I was in for a series of medical shocks. On top of having a second set of twins (which was shocking enough!) I suffered paralysis of the left vocal cord, which came on suddenly, soon after my caesarean section and left me barely able to speak for several months. I didn’t know if my voice would return, since what had happened to me was extremely rare and doctors were scratching their heads with no explanation. I am a teacher, my voice is my livelihood, so I was worried that I wouldn’t be able to teach anymore. Fortunately, it improved on its own and I was speaking normally again 4 months later.

But the shocks weren’t over yet, a couple of months after my voice returned I slipped on water on the bathroom floor and landed hard on my wrist, fracturing it badly enough to need surgery and a plate to repair it.

I was lucky my injuries were relatively minor; but it hit home how quickly things can change. You can be perfectly healthy one minute, then be incapacitated the next. My husband had to stop work to look after the kids, and being on maternity leave, I couldn’t use my sick leave or work income protection. We realised how much we would struggle if a real illness or tragedy struck. In my family, I am the main breadwinner. So if I were to be seriously injured or die suddenly, my family would be put in a very bad position. With 5 little kids, it was important to be prepared. I got started organising Wills and Powers of Attorney right away.

Enter the Fearless Folder…

In both the Barefoot Investor and the Barefoot Investor for Families; Pape recommends putting together a ‘Fearless Folder’; a file of important documents and your instructions, so your family will be ok if anything happens to you. I’m the main financial organiser in my family; if I died, figuring out all this information would be very tough for my husband, and sorting out a financial nightmare is the last thing a grieving person needs.

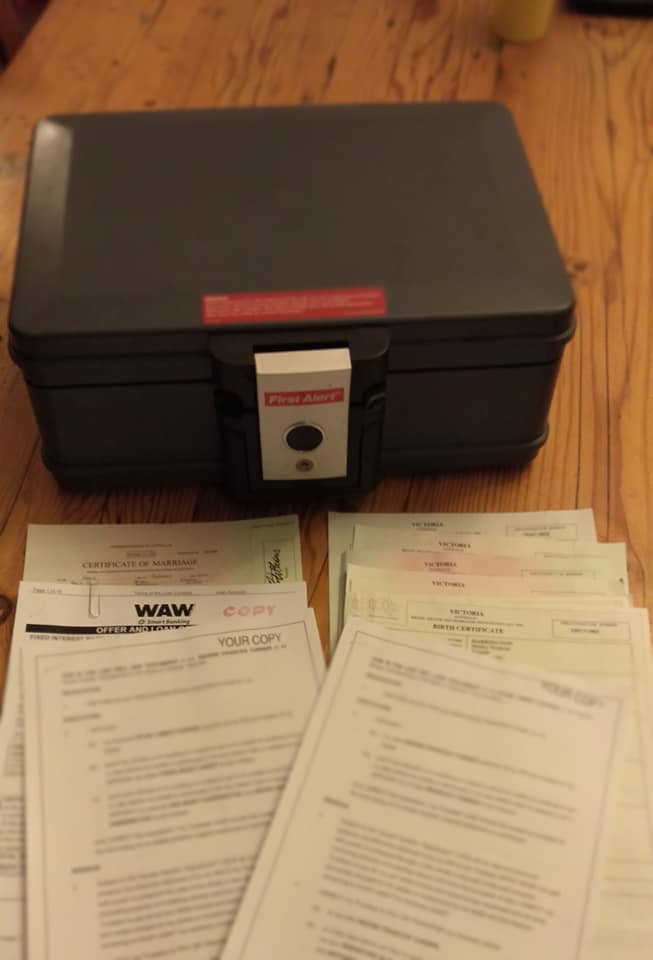

So I’ve put together the ‘Fearless Folder’ in a waterproof, fireproof document safe with carry handle so you can grab it easily in an emergency. The safe is $79 from Bunnings and is recommended by Pape in the Barefoot Investor for Families.

The safe contains:

✓Both our Wills (done for free through my work union. The union did both my Will and my husband’s Will).

✓Powers of Attorney, both Enduring POA and Medical POA for both myself and my husband. I paid $330 for this to be done through a local solicitor. It can be done for free if you do it yourself, but I preferred to pay a professional and have it done correctly.

✓All birth certificates, marriage certificate, passports

✓Home loan/property paperwork

✓The fearless answers: answers to a series of important questions that would be asked if I were to die; e.g. organ donation, who would take the kids if we both die

✓My funeral instructions (cheap funeral, fun, boozy party afterwards!)

✓People who can help, and their details (accountant, executor, lawyer etc.)

✓The Big List: account and login details to social media, bank accounts, government stuff like Medicare and MyGov, Investment stuff, insurance stuff etc.

✓My net worth: a list of all assets and liabilities

✓Details about my life insurance policy. 10 times your annual income is recommended.

✓Details about income protection. I have this matched to my current income. Both my life insurance and income protection are through Superannuation, I just increased them above the default amounts.

✓Finally, I wrote small letters to my husband and 5 little boys. Just in case my death was sudden, so I have a chance to tell them how much I love them and how special they are to me.

Time to relax and enjoy life!

I feel a sense of relief getting this done; now I can relax, knowing that my family is protected and if anything happened to me, they would be ok.

No matter how young you are, you just never know what the future will bring, it’s important to be prepared.